Conic Economics

Conic Economics is an attempt to model modern general equilibria under uncertainty based on the recognition that all risks cannot be eliminated, perfect hedging is not possible, and some risk exposures must be tolerated. Therefore, we need to define the set of acceptable risks as a primitive of the financial economy. This set will be a cone, hence the word conic. Such a conic perspective challenges classical economics by introducing finance into the economic models and enables us to rewrite major chapters of classical micro- and macro-economics textbooks. The classical models dictate that economic players are able to trade the whole of their endowments at what is known as a market-clearing price and direct all proceeds to the consumption of goods and services. According to these models, the aggregate consumption does not exceed the total endowment, suggesting that finance is not a necessary component in the economy. Conic Economics proposes a case in which some gap occurs between the aggregate supply and demand whereby the financial primitives cover the aforementioned gap. This also generates a bid-ask spread at equilibrium depending on the cone of acceptable risks. This work questions the traditional law of one price and poses a direct challenge to Adam Smith’s “invisible hand” theory. Since the housing crisis in 2008, economists and statisticians have questioned the law of one price. The implications of this academic debate are sweeping and affect players at all levels of the economy.

The perceived empirical failures of the standard complete markets general equilibrium model stimulated the development of this work. For example, the standard complete markets model has the following empirical problems: (1) there is too much correlation between individual income and consumption growth in micro data; (2) the equity premium is larger in the data than is implied by a representative agent asset-pricing model with reasonable risk-aversion parameter; and (3) the risk-free interest rate is too low relative to the observed aggregate rate of consumption growth. There have been numerous attempts to explain these puzzles by altering the preferences in the standard complete markets model. Alternatively, one might as well abandon the complete markets assumption and replace it with some versions of either exogenously or endogenously incomplete markets. However, this work takes a totally different approach in the sense that the classical complete markets models will be sub-cases of the proposed conic framework.

Conic Edgeworth Box

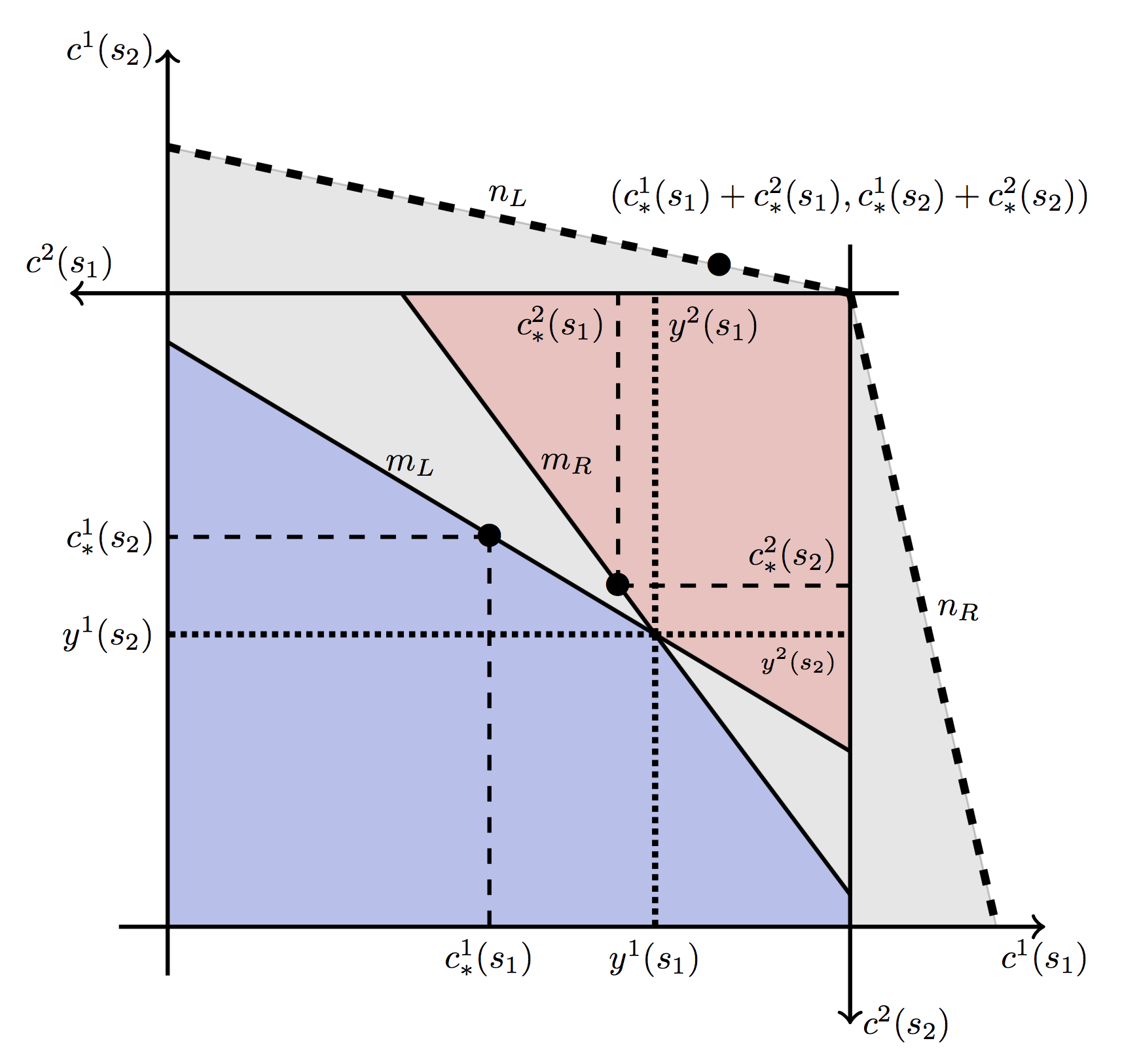

A Conic Economy can be best illustrated by means of the conic Edgeworth box depicted the following figure.

The conic Edgeworth box reminds us of the metaphor thinking out of the box. In particular, in a conic economy, the aggregate consumption is allowed to go beyond the box defined by the aggregate endowments in some states of the world, whereby the financial primitives cover the resulting gap. Hence, the conic economy is a bigger economy because it is willing to absorb some aggregate risk. The economy hopes not to end up in a bad state of the world but if it does, it is just like the Federal Reserve stepping in and covering the loss.

Citation

@phdthesis{raissi2016conic,

title={Conic economics},

author={Raissi, Maziar},

year={2016},

school={University of Maryland, College Park}

}